Step into the hidden machinery of the economy cycle — the recurring rhythm of booms, busts, and renewals that shapes the world economy. This podcast episode brings together the sharp foresight of How Countries Go Broke: The Big Cycle by Ray Dalio and the moral clarity of The Invisible Debt Trap by Zayd Haji, founder of IFR Islamic Finance Research, to explore the powerful yet dangerous forces driving global finance.

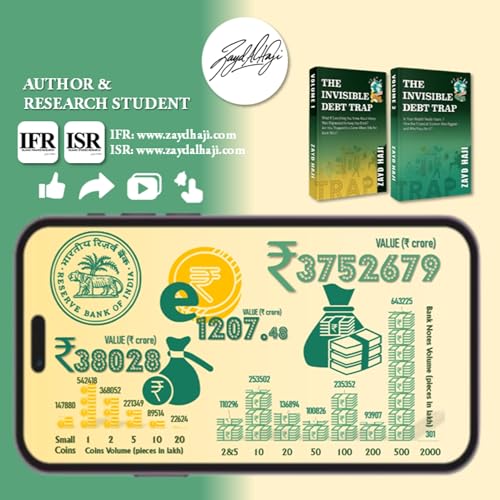

The Invisible Debt Trap series by Zayd Iqbal Haji reveals how interest-based systems enslave nations, destroy families, and erode your wealth.

Volume 01 – How Interest-Based Systems Enslave Nations, Destroy Families, and Defy God: Exposing Riba, Reviving Justice

https://play.google.com/store/books/details/Zayd_Haji_The_Invisible_Debt_Trap_Volume_01_How_In?id=jcFqEQAAQBAJ

Volume 02 – Is Your Wealth Really Yours — Are You Financing Your Own Destruction?: How Riba, Debt, and Modern Banking Are Destroying Your Wealth — Are You In It Too?

https://play.google.com/store/books/details/Zayd_Haji_The_Invisible_Debt_Trap_Volume_02_Is_You?id=FsVqEQAAQBAJ

From emerging market debt to sovereign defaults, from stock market highs to global financial crisis, the conversation traces how the business cycle in economics follows a predictable pattern: credit expands, optimism surges, spending rises — until debt outpaces income. Then the downturn begins, a recession sets in, and in some cases, a global economic crisis shakes the foundations of nations.

Ray Dalio’s framework shows how the economic trade cycle operates on both short-term and long-term scales. Short-term credit cycles drive market swings, while long-term debt cycles — spanning decades — determine the fate of empires. At the same time, Zayd Haji uncovers how the debt market, when dominated by Riba (usury), traps individuals and countries alike in an endless loop of obligation — a debt trap that corrodes both economic health and moral integrity.

We revisit critical historical turning points: the Great Depression, Japan’s asset bubble collapse, the 2008 global financial crisis, and the currency shocks that reset monetary policy across the globe. Each moment reveals how flawed systems, left unchecked, can destabilize a mixed economy & ripple through the global market.

Yet, within this cycle lies a choice. Islamic finance principles — grounded in justice, risk-sharing, and real-asset backing — offer a blueprint for sustainable economic development. Instruments like Mudarabah, Musharakah, Waqf, and Zakat turn money from a speculative tool into a means of productive growth. This model not only resists the debt trap but also aligns economic activity with ethical responsibility.

The economic analysis presented here merges historical evidence with moral reasoning, showing that prosperity without justice is fragile. The economic calendar can predict when interest rates will shift or when fiscal tightening may occur, but only moral discipline can prevent cycles from becoming destructive.

We also explore how reserve currency status affects the world economy — granting dominance in the global market but also creating vulnerabilities when political division, declining productivity, and excessive borrowing converge. History warns that no nation escapes the consequences forever.

By the end of this discussion, you’ll see the economy cycle not as an unavoidable force but as a reflection of collective decisions, values, and systems. The path forward demands rethinking debt, reforming monetary policy, and embracing frameworks that prioritize shared prosperity over short-term gain.

Principles By Ray Dalio | Zayd Haji | IFR Islamic Finance Research is your invitation to understand the mechanics of cycles — and to break free from the ones designed to keep you bound.

28 分

28 分 31 分

31 分 32 分

32 分 35 分

35 分 24 分

24 分 24 分

24 分 17 分

17 分 17 分

17 分