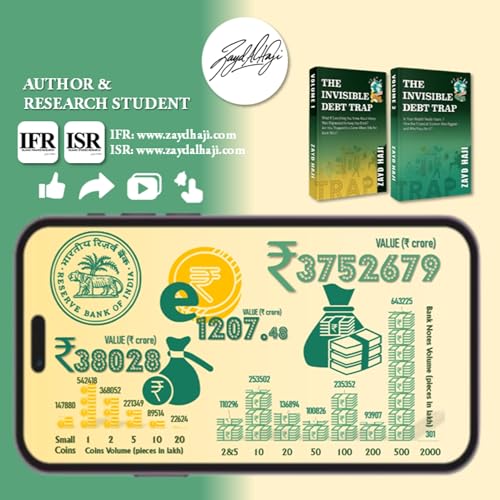

INDIA’s RBI Currency in Circulation Report: Inflation, Monetary Policy, Digital Rupee, Economic Growth & Global Market Implications | Modern Monetary Theory: Economic Insights | IFR Islamic Finance

カートのアイテムが多すぎます

カートに追加できませんでした。

ウィッシュリストに追加できませんでした。

ほしい物リストの削除に失敗しました。

ポッドキャストのフォローに失敗しました

ポッドキャストのフォロー解除に失敗しました

-

ナレーター:

-

著者:

このコンテンツについて

India’s latest RBI Currency in Circulation data offers a powerful signal for the global market, highlighting how inflation is quietly reshaping monetary behaviour and impacting key indexes such as the Nifty 50, Sensex today, and even global benchmarks like the S&P 500. When viewed through the lens of modern monetary theory, the rapid rise of the digital rupee becomes more than a policy update — it reflects a new phase in monetary policy and fiscal policy that is already influencing stock market sentiment and economic activity both domestically and internationally. As home loan interest rates adjust in response to rising inflation rate pressures, investors across the share market, forex trading, and foreign exchange market are beginning to reconsider their exposure to long-term debt in anticipation of potential economic recession. At the same time, short-term liquidity trends are driving increased volatility in the us market and forex factory indicators linked to global trade. By understanding how the RBI’s decisions flow through the broader market, investors gain critical insight into coming cycles of economic growth, potential recessions, and currency movements that directly influence the forex and stock market environment.

In this episode, Zayd Haji uncovers how subtle changes in India’s currency circulation reveal powerful signals about inflation rate, monetary policy, economic growth and the broader global market landscape. You will learn why the Rupees 500 note now dominates cash transactions, why the Rupees 2,000 note is disappearing, and how the introduction of the e-Rupee marks the next phase of economic activity in India.

The Invisible Debt Trap series by Zayd Iqbal Haji reveals how interest-based systems enslave nations, destroy families, and erode your wealth.

Volume 01 : How Interest-Based Systems Enslave Nations, Destroy Families, and Defy God: Exposing Riba, Reviving Justice

https://play.google.com/store/books/details/Zayd_Haji_The_Invisible_Debt_Trap_Volume_01_How_In?id=jcFqEQAAQBAJ

Volume 02 : Is Your Wealth Really Yours — Are You Financing Your Own Destruction?: How Riba, Debt, and Modern Banking Are Destroying Your Wealth — Are You In It Too?

https://play.google.com/store/books/details/Zayd_Haji_The_Invisible_Debt_Trap_Volume_02_Is_You?id=FsVqEQAAQBAJ

These trends are directly tied to rising inflation and new forms of monetary policy that resemble concepts found in modern monetary theory. As digital finance becomes the new default, the way money circulates within the domestic market, the forex market and the global trade system is quietly being rewritten. The episode goes on to explore how this concentration of currency value connects to the long-term credit cycle, short-term debt cycle and liquidity patterns.

You will gain a practical understanding of how government fiscal policy and central bank actions influence everything from forex trading and home loan interest rates to corporate earnings in the stock market and movements in the international foreign exchange market. Zayd explains how inflation rate pressures ripple through the economy and eventually impact consumer spending, economic activity levels, and even long-term investment decisions in the global market.

This episode also shows that economic growth and recessions are not random — they follow predictable cycles based on debt accumulation, spending behaviour and monetary stimulus. When borrowing expands, asset prices in the stock market and share market tend to rise; when debt burdens reach their peak, economic recession becomes unavoidable, leading to declines in the forex factory of global trade and contraction in the foreign exchange market.

But this is not just a discussion of economic data. Zayd Haji connects the insights to timeless Islamic principles, emphasising the importance of transparency, justice, ethical monetary policy and the avoidance of riba in times of rising inflation and digital transformation.