Low, Loud & Legit - Dr. John Ulloa on the Economics of Lowriding

カートのアイテムが多すぎます

カートに追加できませんでした。

ウィッシュリストに追加できませんでした。

ほしい物リストの削除に失敗しました。

ポッドキャストのフォローに失敗しました

ポッドキャストのフォロー解除に失敗しました

-

ナレーター:

-

著者:

このコンテンツについて

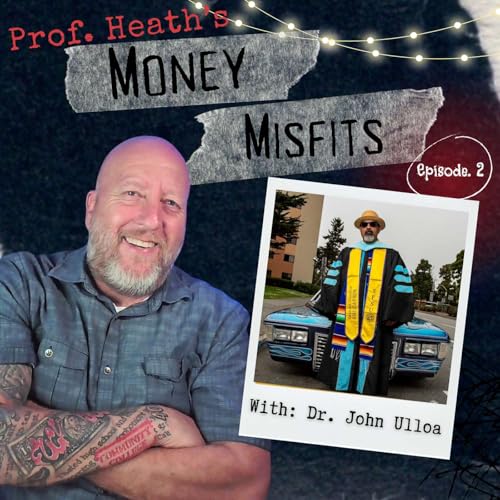

Money Misfits, Episode 2 – I sat down with Dr. John Ulloa—a community college dean, cultural historian, and lowrider builder—who unpacks his journey from welding shops to classrooms and car shows. I loved this conversation as it’s a dive into the economics of culture, identity, and education. I walked away from the conversation more convinced than ever that personal finance isn’t just about spreadsheets—it’s about how we invest in who we are, and where we come from. Personal finance is just another tool for us to do really fuckin cool things.

Dr. Ulloa shares how lowriding became more than just a car hobby: it became a form of cultural expression, resistance, and identity. He traces its roots from Chicano postwar pride to the modern-day realities of gentrification. We learn how the price of building a lowrider today is “like buying a house”, and what that says about the shifting accessibility of the culture.

But this isn’t just about lowriding. Dr. Ulloa opens up about his own educational and financial journey—from struggling student to college professor, and eventually, academic dean. He talks about the cost of education, student loans, the sacrifices he made for his family, and how he had to hustle both in and outside the system to stay afloat.

Money Lessons from the Episode

- Gentrification has an economic cost: what used to be built with scrap parts now costs tens of thousands. Cultural authenticity is being priced out.

- Welding = equity: Learning a trade gave John more than a paycheck—it gave him a path to financial agency and creative expression.

- Student loans were a necessity: His path through higher ed wasn’t easy or cheap, but it was intentional. He talks openly about debt and return on investment.

- Budgeting passion: Whether it’s building a lowrider or raising a family, John discusses the need to align your finances with your values.

Im obviously just getting started here with this podcast, but the value from these conversations is already becoming clear to me. Real misfits fold sound personal financial literacy concepts into their daily lives to chase dreams and goals. The rest of us should learn how to do the same!

Professor Heath