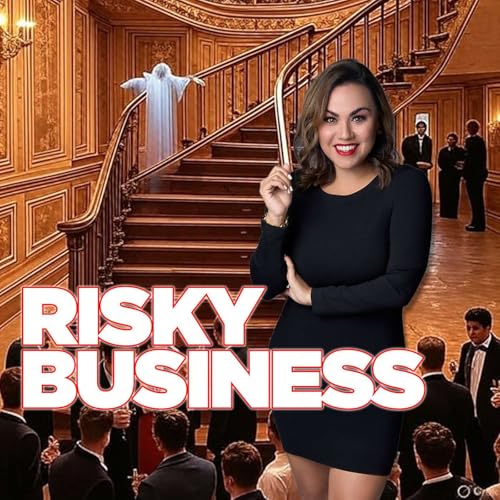

Jessica's Risky Business

カートのアイテムが多すぎます

ご購入は五十タイトルがカートに入っている場合のみです。

カートに追加できませんでした。

しばらく経ってから再度お試しください。

ウィッシュリストに追加できませんでした。

しばらく経ってから再度お試しください。

ほしい物リストの削除に失敗しました。

しばらく経ってから再度お試しください。

ポッドキャストのフォローに失敗しました

ポッドキャストのフォロー解除に失敗しました

-

ナレーター:

このコンテンツについて

Insurance doesn’t have to be dull — and Jessica Villarreal is here to prove it. Every Friday, she takes you inside the high-stakes world of business, risk, and claims with unapologetic energy and fearless insight. From behind-the-scenes war stories to real-world strategies that keep businesses alive when things go sideways, this podcast is equal parts bold, fun, and just a little dangerous. If you came for boring, you’re in the wrong place.

© 2025 Jessica's Risky Business

エピソード

-

2025/10/1710 分

2025/10/1710 分カートのアイテムが多すぎます

ご購入は五十タイトルがカートに入っている場合のみです。カートに追加できませんでした。

しばらく経ってから再度お試しください。ウィッシュリストに追加できませんでした。

しばらく経ってから再度お試しください。ほしい物リストの削除に失敗しました。

しばらく経ってから再度お試しください。ポッドキャストのフォローに失敗しました

ポッドキャストのフォロー解除に失敗しました

-

10 分

10 分カートのアイテムが多すぎます

ご購入は五十タイトルがカートに入っている場合のみです。カートに追加できませんでした。

しばらく経ってから再度お試しください。ウィッシュリストに追加できませんでした。

しばらく経ってから再度お試しください。ほしい物リストの削除に失敗しました。

しばらく経ってから再度お試しください。ポッドキャストのフォローに失敗しました

ポッドキャストのフォロー解除に失敗しました

-

2025/10/037 分

2025/10/037 分カートのアイテムが多すぎます

ご購入は五十タイトルがカートに入っている場合のみです。カートに追加できませんでした。

しばらく経ってから再度お試しください。ウィッシュリストに追加できませんでした。

しばらく経ってから再度お試しください。ほしい物リストの削除に失敗しました。

しばらく経ってから再度お試しください。ポッドキャストのフォローに失敗しました

ポッドキャストのフォロー解除に失敗しました

まだレビューはありません