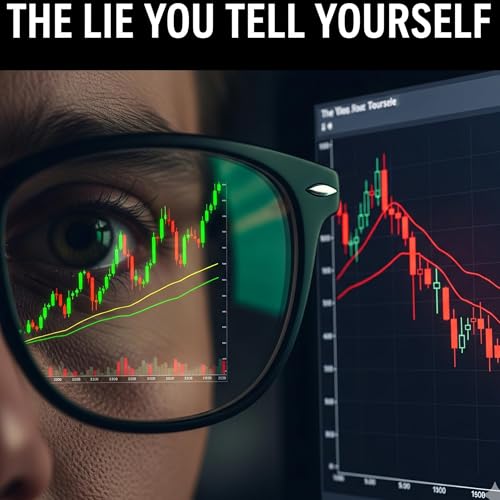

Confirmation Bias: Why You Only See "Good News" About Your Losing Stocks

カートのアイテムが多すぎます

カートに追加できませんでした。

ウィッシュリストに追加できませんでした。

ほしい物リストの削除に失敗しました。

ポッドキャストのフォローに失敗しました

ポッドキャストのフォロー解除に失敗しました

-

ナレーター:

-

著者:

このコンテンツについて

Have you ever held onto a losing stock, actively searching for any piece of news that confirms your initial decision was the right one? This is Confirmation Bias, a dangerous mental shortcut that makes us favor information that confirms our existing beliefs while ignoring contradictory evidence.In this episode of Investment Psychology Explained, we unpack the science behind this powerful cognitive bias. Based on insights from an article in "Mint" by Dhirendra Kumar of Value Research, we explore why this bias feels so comfortable and how it systematically leads investors to make poor decisions, like holding onto losing assets for too long.---Prefer to watch? Find the video version of this episode and our visual guides on our YouTube channel:https://www.youtube.com/@PsychologyInvest---This episode is essential for any investor who wants to break free from subconscious patterns and start making decisions based on reality, not hope.#ConfirmationBias #Investing #BehavioralFinance #StockMarket #InvestmentPsychology