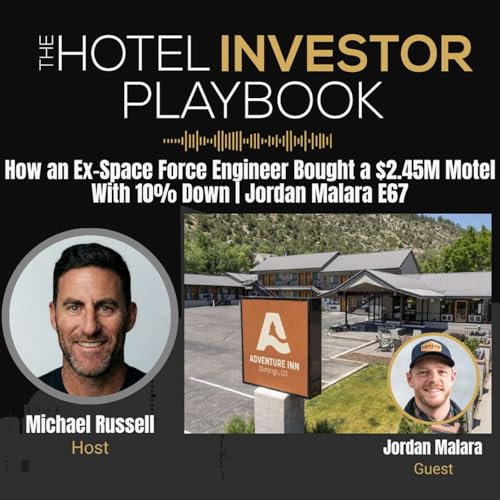

The Hotel Investor Playbook

カートのアイテムが多すぎます

ご購入は五十タイトルがカートに入っている場合のみです。

カートに追加できませんでした。

しばらく経ってから再度お試しください。

ウィッシュリストに追加できませんでした。

しばらく経ってから再度お試しください。

ほしい物リストの削除に失敗しました。

しばらく経ってから再度お試しください。

ポッドキャストのフォローに失敗しました

ポッドキャストのフォロー解除に失敗しました

-

ナレーター:

-

著者:

-

Michael Russell

概要

With an operator-first mindset, Michael brings a practical perspective to hotel investing. On the show, he breaks down what it actually takes to scale from short-term rentals into boutique hotels, covering deal sourcing, operations, capital strategy, and risk.

Each week, Michael shares real lessons from the field as he builds toward a $400 million real estate business, giving listeners an honest look at the decisions, challenges, and strategies behind the growth. Subscribe and follow along as he documents the journey in real time.

エピソード

-

2026/02/0334 分

2026/02/0334 分カートのアイテムが多すぎます

ご購入は五十タイトルがカートに入っている場合のみです。カートに追加できませんでした。

しばらく経ってから再度お試しください。ウィッシュリストに追加できませんでした。

しばらく経ってから再度お試しください。ほしい物リストの削除に失敗しました。

しばらく経ってから再度お試しください。ポッドキャストのフォローに失敗しました

ポッドキャストのフォロー解除に失敗しました

-

52 分

52 分カートのアイテムが多すぎます

ご購入は五十タイトルがカートに入っている場合のみです。カートに追加できませんでした。

しばらく経ってから再度お試しください。ウィッシュリストに追加できませんでした。

しばらく経ってから再度お試しください。ほしい物リストの削除に失敗しました。

しばらく経ってから再度お試しください。ポッドキャストのフォローに失敗しました

ポッドキャストのフォロー解除に失敗しました

-

1 時間 7 分

1 時間 7 分カートのアイテムが多すぎます

ご購入は五十タイトルがカートに入っている場合のみです。カートに追加できませんでした。

しばらく経ってから再度お試しください。ウィッシュリストに追加できませんでした。

しばらく経ってから再度お試しください。ほしい物リストの削除に失敗しました。

しばらく経ってから再度お試しください。ポッドキャストのフォローに失敗しました

ポッドキャストのフォロー解除に失敗しました

まだレビューはありません