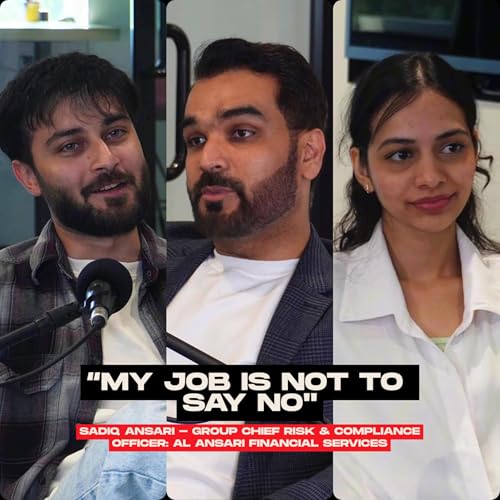

In this episode of The Dollar Diaries podcast, host Aditya Poddar interviews Sadiq Ansari, Group Chief Risk & Compliance Officer at Al Ansari Financial Services, who shares his unique journey into the financial crime compliance field. Originally a chartered accountant and treasury professional, Sadiq stumbled into financial crime regulation while working at the UAE Central Bank. Over his 16-year career, he gained extensive experience managing financial crime risks, contributing to sectoral regulations, and participating in international evaluations, ultimately shaping him into a seasoned expert in the discipline. He highlights the evolving nature of financial crime compliance as a formal career path, which was previously informal and often stumbled upon by chance.

Sadiq discusses some of his most challenging cases, including the high-profile meltdown of UAE Exchange and their takeover by the central bank, where he worked intensively to safeguard stakeholders' interests. He emphasizes that financial crime compliance extends beyond banks to encompass customs, law enforcement, and legislative bodies, showing the complexity and interdisciplinary nature of the field. Drawing from his experience, he underscores the importance of strong leadership, oversight, and a risk-based approach to compliance. He explains how Al Ansari Financial Services has integrated rigorous risk management frameworks across multiple jurisdictions, balancing regulatory requirements with investor appetite, and nurturing transparent governance to mitigate both financial and reputational risks.

The episode further explores how financial institutions adapt to rapidly changing regulatory landscapes, the critical role of collaboration with legal teams and regulators, and the increasing incorporation of technology in compliance functions. Sadiq stresses that while technology and innovation are vital, risk awareness must remain central, and compliance officers must be embedded in the development process to manage new risks effectively. Concluding on a forward-looking note, he views the region’s financial crime compliance environment as evolving and promising, with growing formalization and increased awareness offering exciting career opportunities. His positive outlook highlights the expanding role of risk and compliance professionals amid ongoing fintech advancements and regulatory enhancements.

A dynamic mix of personalities and expertise, each bringing unique energy to the table. Abubakr Sajith, the unofficial leader (even if he didn’t ask for it), keeps things running smoothly with his finance, IT, and entrepreneurial background. Gazala Parkar, the PR pro, is the team’s caring yet no-nonsense mother figure, while Guhaesh Subramanian, the ever-networking master's student, plays the carefree uncle. Anas Memon is the resident numbers guy deep in finance, M&A, and private equity. At the same time, Aditya Poddar, with his love-hate relationship with his 9-to-5, embraces his role as the team’s laid-back producer. Eiman Ansari, the cybersecurity expert, provides comedic relief when she shows up alongside Liz Ann D’Souza, the creative force with a film and content creation background. And then there’s Zainab Netterwala, the IT and computer science whiz, who takes on the role of the little sister in this eclectic, ever-evolving crew.

Connect with Us! 🌐

X / Twitter: https://twitter.com/dollar_diaries

Instagram: https://www.instagram.com/dollardiariespodcast

LinkedIn: https://www.linkedin.com/company/thedollardiariespodcast

TikTok: https://www.tiktok.com/@thedollardiaries

Chapters:

00:00 - 00:23 - Trailer

00:23 - 01:00 - Guest intro

01:00 - 05:05 - Journey into financial crime regulation at UAE Central Bank

05:05 - 06:34 - Education & qualifications for financial crime compliance

06:34 - 10:59 - UAE Exchange collapse

10:59 - 15:19 - Oversight, leadership, and avoiding organizational failures

15:19 - 20:55 - Risk frameworks & evolving compliance in UAE, Kuwait, Bahrain

20:55 - 25:31 - Corporate governance, board dynamics & investor relations

25:31 - 32:57 - New risks, acquisitions & regulatory evolution

32:57 - 37:59 - Consulting vs corporate world

37:59 - 43:46 - Managing regulators, legal teams & reputational risk

43:46 - 47:47 - Tech in compliance & future of risk management in the region

47:47 - 48:31 - Closing thoughts & positive outlook

1 時間 2 分

1 時間 2 分 42 分

42 分 2025/12/1453 分

2025/12/1453 分

55 分

55 分 46 分

46 分 1 時間 2 分

1 時間 2 分 49 分

49 分