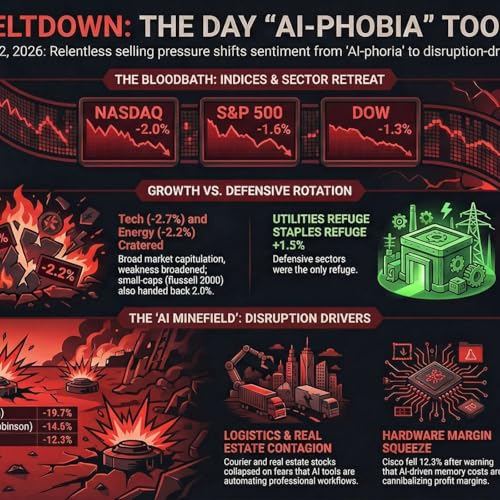

PSW Commuter Report: Market Meltdown - AI-Phobia Takes Control

カートのアイテムが多すぎます

ご購入は五十タイトルがカートに入っている場合のみです。

カートに追加できませんでした。

しばらく経ってから再度お試しください。

ウィッシュリストに追加できませんでした。

しばらく経ってから再度お試しください。

ほしい物リストの削除に失敗しました。

しばらく経ってから再度お試しください。

ポッドキャストのフォローに失敗しました

ポッドキャストのフォロー解除に失敗しました

-

ナレーター:

-

著者:

概要

まだレビューはありません